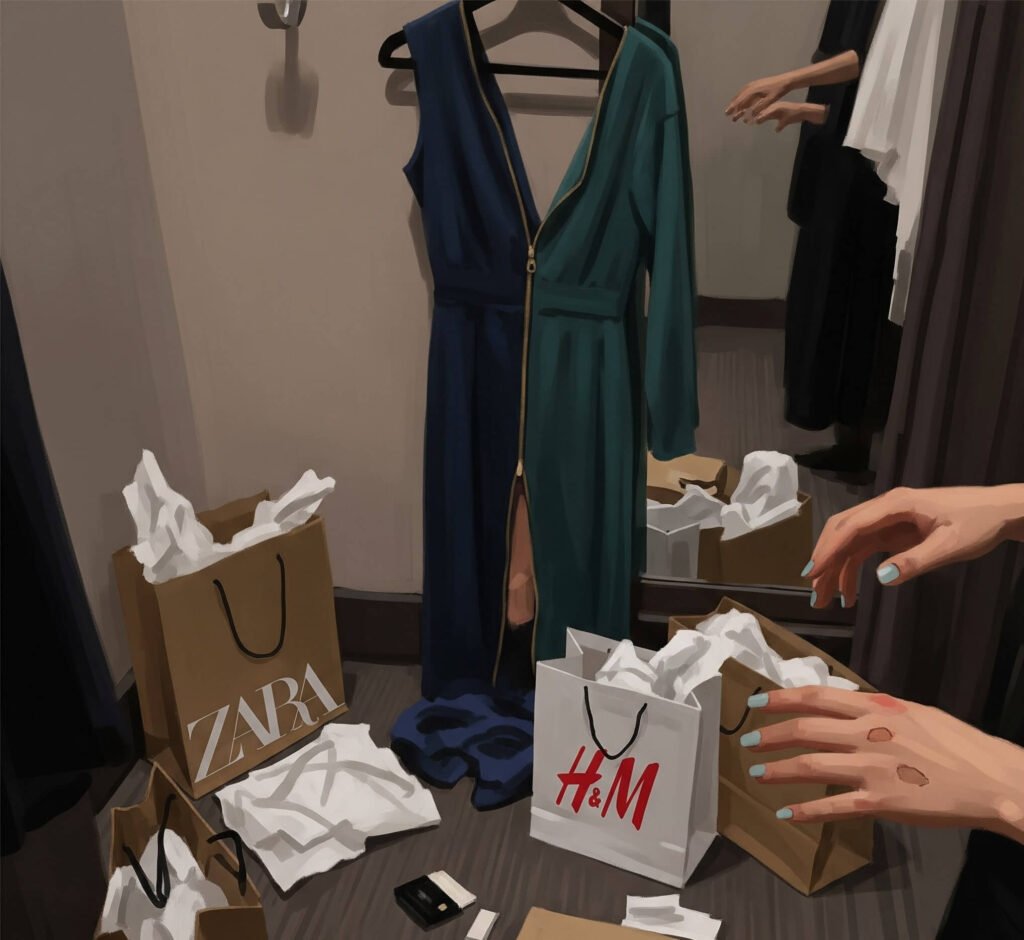

Fast fashion face-off’s got me acting unwise, y’all, and I’m writing this from a wobbly table at a Brooklyn coffee shop that smells like burnt espresso and hipster dreams. My H&M scarf’s already fraying, my Zara jeans have a suspicious stain (oat milk? Maybe?), and I’m surrounded by crumpled receipts from my latest shopping spree. Like, why do I keep doing this? I’m a mess, sitting here with a half-dead pen, ranting about Zara vs H&M in 2025 while the barista judges me. This fast fashion face-off is my life’s drama, and I’m spilling all my embarrassing stories from my broke, American perspective.

Why This Fast Fashion Face-Off’s Got Me Stressed

Zara and H&M are like my frenemies—love ‘em, hate ‘em, can’t quit ‘em. Last week, I was at Zara’s SoHo store, losing my dang mind over their fall drop. The vibes were chef’s kiss—sleek racks, moody lights, all that jazz. I snagged this oversized blazer that looked fire, but when I got home, it fit like a cardboard box. H&M, though? I grabbed a $15 dress from their Times Square spot for a rooftop party—felt cute till the hem started unraveling mid-TikTok dance. Fast fashion face-off in 2025 is a rollercoaster, and I’m out here screaming.

Here’s the tea:

- Trend Overload: Zara’s dropping new stuff every other day, and I can’t keep up. H&M’s not far behind, but their stuff’s more… basic? Zara’s got that influencer vibe, but H&M’s my go-to for cheap staples.

- Price Woes: H&M’s stupid cheap, which is bad for my bank account. Zara’s prices make me wince—like, $80 for a jacket? I’m not made of money!

- Sustainability Side-Eye: Both are yelling about “sustainable fashion” in 2025, but I’m skeptical. Zara’s “Join Life” sounds nice, but is it real? H&M’s Conscious Collection feels like a marketing ploy, but what do I know?

Zara’s Winning (Kinda) in This Fast Fashion Face-Off

Zara’s like that friend who’s always extra. Their stores feel like a fancy boutique, not some fast fashion joint. I was at their Fifth Ave store a few weeks ago, trying on this faux-leather trench that had me feeling like a spy in a movie. But $90? I almost cried. Still bought it, tho, because I’m an idiot. Zara’s fast fashion face-off game is strong—they’re on every trend before it even hits X, and their fits are usually fire. But, like, I’ve had zippers break and seams pop way too quick.

Zara’s killing it with:

- Trend Speed: They’re on top of every TikTok fad. That viral Y2K aesthetic? Zara had it in stores before I could say “low-rise jeans.”

- Store Vibes: Their stores are so chic, I forget I’m broke. I get sucked in every time.

- Global Reach: Inditex’s 2024 report says Zara’s got like 2,000 stores worldwide. Their supply chain’s a machine, man.

But, real talk, I once wore a Zara top to a brunch and it shrank in the wash. I looked like I was wearing a baby shirt—mortifying. Why do I keep falling for this?

H&M’s My Chaotic Soulmate in the Fast Fashion Face-Off

H&M’s like that messy friend you love anyway. Their stores are a hot mess—clothes everywhere, sale signs screaming—but I’m obsessed. Last weekend, I was digging through their Williamsburg store and found $10 jeans that fit like a glove. Wore ‘em to a dive bar, spilled beer, and they still looked decent. H&M’s not trying to be Zara’s polished cousin; they’re the cheap, unhinged option, and I’m here for it. But their quality? Oof. I’ve had more H&M stuff fall apart than I wanna admit.

H&M’s got:

- Budget Vibes: H&M’s so cheap, I can grab a whole outfit for like $40. Dangerous, but I’m not complaining.

- Collab Hype: Their designer collabs are iconic. I still cry over missing the H&M x Balmain drop. Sat refreshing the site for hours—nothing.

- Sustainability Questions: H&M’s pushing their Conscious Collection, but I’m like, “Is this recycled polyester really saving the planet?” I wanna believe, but I’m not sold.

Fast Fashion Face-Off: Who’s Stealing My Heart (and Cash)?

Okay, let’s get real messy. Zara makes me feel like I could be an influencer, but H&M’s my broke-girl savior. In this 2025 fast fashion face-off, Zara’s winning for style and speed, but H&M’s got my heart for those $10 deals. I’m so torn, y’all! Zara’s got that vibe, but I’m over crying when their stuff falls apart. H&M’s my budget bestie, but I’m tired of threads unraveling mid-date. Like, why can’t I quit either of them?

My hot mess take? Neither’s perfect. Both are feeding my fast fashion addiction while pretending to be “sustainable.” I’m trying to shop smarter—hitting thrift stores, stalking vintage finds on X, maybe even learning to sew (lol, yeah right). But I’m still a sucker for this fast fashion face-off, still buying stuff I don’t need, still tripping over my own dumb choices.

Tips for Surviving This Fast Fashion Face-Off

From one trainwreck to another, here’s what I’ve learned:

- Check the Quality: Feel the fabric, tug the seams. Zara’s stuff looks fancy but can be flimsy. H&M’s a gamble, so inspect it good.

- Sale Hustle: Zara’s sales are sneaky—check their app. H&M’s clearance racks are gold if you dig. I got a $5 skirt once, still wear it!

- Skip the Hype: If it’s a trend you’ll ditch in a month, don’t buy. I’m still haunted by that Zara bucket hat phase—yikes.

- Dig into the Eco Stuff: Both brands talk big about sustainability, but check Fashion Revolution for the real scoop.

Wrapping Up My Fast Fashion Face-Off Rant

So, who’s winning this fast fashion face-off in 2025? Zara’s got the style crown, but H&M’s my budget MVP. I’m sitting here, sipping my overpriced latte, staring at my stuffed closet, and laughing at my dumb self. I’m a mess, but I’m trying—kinda. If you’re caught in this fast fashion face-off too, drop your fave Zara or H&M finds in the comments. Or, like, tell me how to quit this cycle before I go broke. I need inspo, for real!

Outbound links :